I’ve read a few books this summer that look at non-traditional economies. Chris Anderson‘s Free deals with “the future of a radical price”; Tara Hunt‘s The Whuffie Factor looks at the currency of reputation; and Clay Shirky‘s Here Comes Everybody talks about the power of self-organizing systems.

I’ve read a few books this summer that look at non-traditional economies. Chris Anderson‘s Free deals with “the future of a radical price”; Tara Hunt‘s The Whuffie Factor looks at the currency of reputation; and Clay Shirky‘s Here Comes Everybody talks about the power of self-organizing systems.

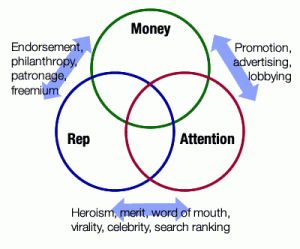

Chris and Tara’s books, at their core, deal with a single concept: that a connected society has three distinct economies — money, reputation, and attention — and that businesses depend on their ability to move value between the economies. And Clay’s book shows us that these economies can emerge by themselves without formal organization.

None of these economies are new. It’s just that in an online world, we have more ways of tracking them and understanding their exchange rates. Many of today’s most interesting companies are focused on exchanging value between the three economies, giving rise to many new business opportunities and forcing us to think with a “triple bottom line” mentality.

The three economies

The first economy, money, has been around for millennia as a way of keeping score. By converting goods and services to an abstract form of agreed-upon worth, we made value liquid. Rather than having to find someone with whom to barter, we could buy and sell freely. Abstract representations of value also formalized credit and insurance, making them negotiable.

The second economy, which Tara deals with in detail, is reputation. Indeed, the Whuffie in her book’s title is a social currency proposed by Cory Doctorow. While respect for one’s elders has been around since we had elders, it’s only recently that we’ve been able to keep score in a formal manner.

The third economy is attention, and it’s increasingly scarce. In Free, Chris quotes Herbert Simon, who, in 1971, observed that every surplus creates a demand. We live in an information-saturated world, and “a wealth of information creates a poverty of attention.” Some people, media, and organizations can captivate us and direct our attention accordingly.

Inextricably linked

These three economies are inextricably linked.

Converting money to attention is simply advertising.

Trading reputation for money is selling out. When someone cashes in their good name, they lose reputation. That’s one reason Western stars often promote products in Asia they’d never consider speaking about in their home countries. It’s also why William Shatner and Adam West have managed to do it well, by sprinkling a heavy dose of irony and self-deprecation. Indeed, Shatner’s new celebrity is that of shameless pitchman.

Converting attention to reputation is trickier. If you have the eyes of the world and you don’t screw up, you gain its approval. In many ways, humility is the ultimate reputational tool, but heroes and athletes live in this world. Good corporate citizenry builds reputation. This is the “top shelf” philosophy: if you see several well-known brands of vodka on the top shelf of a bar, and one that’s unfamiliar, you’ll assume it’s of the same caliber as the others. Similarly, if a popular Twitter user converses with someone you don’t know, you’re more likely to assume they’re peers.

Conversely, if you’re famous, you can use your reputation to direct attention at things. Every time a movie star promotes a cause in which they believe, they’re transferring some of what they stand for to something else. Endorsement is non-monetary, and endorsing the right things can enhance reputation if the act is seen as selfless (Bono and Bob Geldof, for example.) Tara makes this point — that reputational transactions aren’t zero-sum games the way monetary transactions are.

Converting money to reputation is patronage. A wealthy philanthropist loses money, but gains respect in the community. Bill Gates’ popularity has risen dramatically from the days when he was the Dark Emperor of Redmond now that the world has seen where the empire’s plunder is being spent.

Converting attention to money is sales. Once you have someone’s attention, your ability to transact with them for monetary gain is salesmanship. Of course, if you take time to engage with a prospect (building reputation) you can later cash in that rapport for more sales, something seasoned salespeople understand well.

So what’s changed?

None of these exchanges are new. It’s only recently, however, that we have objective measurements of all three. Just as money was a calculable measure of value, so metrics like Google‘s Page Rank, Twitter’s follower count, and Technorati‘s blog ranking formalize reputation. Similarly, traffic, search frequency, and keyword rankings are reasonably formal measures of attention.

Many of these measurement systems have emerged of their own accord. They’re self-governing — as Clay points out, a few simple rules applied by a great many people lead to surprisingly resilient systems. Millions of tags make Flickr searchable, but also allow specific topics to emerge without anyone coordinating them. Just take a simple behavior like upvoting, adding hashtags, blog linkbacks, or counting inbound links; then apply it to all of Digg‘s readers, millions of Facebook users, or every page on the Web.

We can also measure the exchange rate between the three economies. With the advent of online media, auction-based advertising, and tracking tools, we can increasingly understand how the three are related:

- When a website starts running annoying ads or introduces pop-ups, they’re converting hard-won reputation to hard cash. Reputation and popularity drop even as money flows in.

- If you offer a free version of your software, you’re sacrificing money for attention (since people will try it) and reputation (if they like it). Many of the more recent business models in Chris’s book deal with these kinds of tradeoffs.

- If you’re a funny writer then the free content you publish converts reputation to attention as your followers and subscribers go up.

- If you buy a pre-levelled character for an online video game, you’re trading money (on eBay) for reputation (in the game.) Even for legitimate transactions like those on Second Life, you’re paying Wall Street money for virtual street cred.

Rethinking break-even

Many of today’s startups aren’t break-even from a monetary perspective, but are extremely profitable in other economies. Some companies that could be tremendously profitable have intentionally delayed monetary break-even to gain reputation and attention. Skype is a good example of this; similarly, Twitter’s recently leaked business plans show the company intends to grow to a billion users before it can really convert that attention to money.

What matters is a company’s ability to move value between the three economies:

- Google excels at transforming reputation (both its own and that of the sites it ranks) into attention in the form of traffic.

- Facebook is also playing at this game — borrowing the reputation of your friends to convince you to pay attention to something, and charging companies for the benefit of doing so.

- Craigslist charges for only certain ads in certain cities. Even though the vast majority of ads on Craigslist are free, the company’s reputation is tremendous. Because of this, it gets a lot of attention — and the money it does generate is enviable for a company of its size.

On the other hand, if it’s not clear how to move value between economies, the viability of a particular business is often questioned. Google Apps sacrifices up-front money for long-term dominance, and web-based email sacrifices money for attention, since the service can gain millions of users by keeping it free. But other than through advertising and upselling, it’s hard to see how these companies make money.

On the other hand, online storage service Dropbox (which we use) has carefully thought out how to convert users to paying customers through a clever set of usage and sharing caps.

Don’t eat the marshmallow

For startups, a three-economy mindset begs the question: How long should a company wait to cash out?

Delaying monetary gratification can be a good strategy if your business model has a good exchange rate and deep pockets. At the same time, the longer a company waits, the more likely it is that someone else will figure out their business model — or discover an even better way to move value between those economies.

Not just a metaphor

This isn’t just a mental exercise. Today, the notion of a reputation economy might seem esoteric; but it’s plausible that there may actually be a way to check your reputation balance, at least within a particular industry. This already exists with websites (via PageRank, Technorati, and the like) but as we learn to glean sentiment and relationship strength from social networks, it’ll become more formal — giving rise to new businesses built around economic exchange.

What about reputation insurance, for example? Can you borrow attention, then repay it with interest? Is there a way to store your reputation, then withdraw it later? Can someone hedge against shame? Will we see exchanges and traders? What’s the exchange rate between British reputation and Japanese reputation? Is there a “gold standard” for attention? What’s the reputational equivalent of a credit score — and can you borrow attention at a better rate because of it?

With better metrics to track attention and reputation, more formal economies will emerge. So get ready to check your attention balance, or ask to borrow some reputation. Because now, we have three bank balances, and we have to decide when to spend and when to be thrifty.

@

@ Tags:

Tags:

Like all images on the site, the topic icons are based on images used under Creative Commons or in the public domain. Originals can be found from the following links. Thanks to

Like all images on the site, the topic icons are based on images used under Creative Commons or in the public domain. Originals can be found from the following links. Thanks to

I totally loved this post

Great Post, I like the approach of what will make people lose credibility. I was following a huge debate about the “sponsored tweets” and the point is clear there. If you “sell” your twitter stream you lose credibility when you recommend something because people know you’re getting payed to do that.

The key is to know how to work out through the 3 parallel economies at the same time. Have a Game Plan.

[…] post by Allistair Croll about money, reputation and attention, the Three economies of online […]

[…] The Three Economies of Online Currency. […]

[…] The three economies of online currency […]